Coffey International (Coffey) last reported on 30 April when it advised the market of further restructuring and impairment charges for FY15 driven by the continued decline in iron ore prices and the collapse in oil markets

At that time, Coffey guided that FY15 underlying EBITDA before restructuring costs and impairment would be in the range of $18-20m with net loss after tax in the range of $16-18m. FY15 results were in line with this guidance: FY15 underlying EBITDA was $18.5m and the net loss after tax was $18.1m.

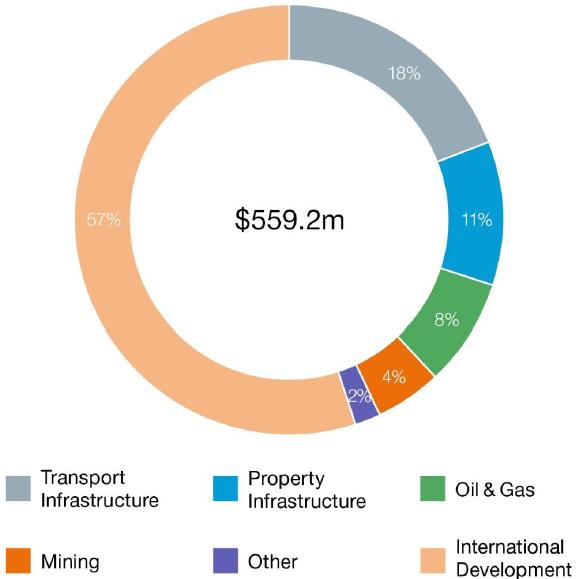

Given significant restructuring costs and the cessation of certain businesses, the company has provided figures for the underlying continuing business for FY15. On that basis, continuing operations produced $559.2m in revenue, $23.5m in underlying EBITDA and NPAT of $5.3m. Full discussion of the restructuring was given in the previous note which can be found in the related articles below “Coffey International 3Q15: Restructuring and impairments”.

As expected, credit metrics have deteriorated over the year with underlying interest coverage (EBITDA/Interest) falling from 3.23x to 2.93x in FY15, while gearing increased to 34% (26% FY14).

Coffey bonds have one of the highest AUD trading margins of around 650bps with investors therefore being paid to take risk exposure to this name - the bond looks fair value. We do not expect material improvement in the credit profile in the medium term.

No FY16 guidance was given. Coffey will provide a 1Q16 trading update at its Annual General Meeting in October 2015.

Summary financials

| FY14 | FY15 | FY15 continuing |

| Total revenue | 628.1 | 579.1 | 559.2 |

| Underlying EBITDA | 26.2 | 18.5 | 23.5 |

| EBITDA | 23.7 | -1.6 | 21.0 |

| Net financing costs | 8.1 | 8.0 | 8.0 |

| NPAT | 4.4 | -18.1 | 5.3 |

| Net debt | 48.1 | 62.4 | 62.4 |

| Underlying EBITDA/Interest | 3.23x | 2.31x | 2.93x |

| Net debt/Underlying EBITDA | 1.84x | 3.37 | 2.65 |

| Net debt/(Net debt+equity) | 26% | 34% | 34% |

Source: FIIG Securities, Coffey

FY15 revenue: Continuing operations

The pie chart depicts Coffey's FY15 revenue in percentage per sector.

Source: Coffey

FY15 EBITDA: Continuing operations

The pie chart depicts EBITDA across the categories of Coffey's business.

Source: FIIG Securities, Coffey

As previously discussed, the company refocused its mining strategy on the later stages of the asset lifecycle, exiting its exploration management and resource delineation practices in Western Australia, South America and Ghana. Coffey has also exited its permanent presence in Canada. The company is now mostly focused on less volatile International Development and Infrastructure. Any exposure to mining/oil/gas is to mature operating facilities and via remediation work.

Outlook

Coffey did not give any FY16 guidance however forward contracted fee revenue by division is given. Positively, overall contracted fee revenue greater than 12 months has increased notably. This has been driven by the International Development sector which posted record contracts in the second half, offset by the expected declines in Geoservices.

Contracted fee revenue (m)

Source: FIIG Securities, Coffey

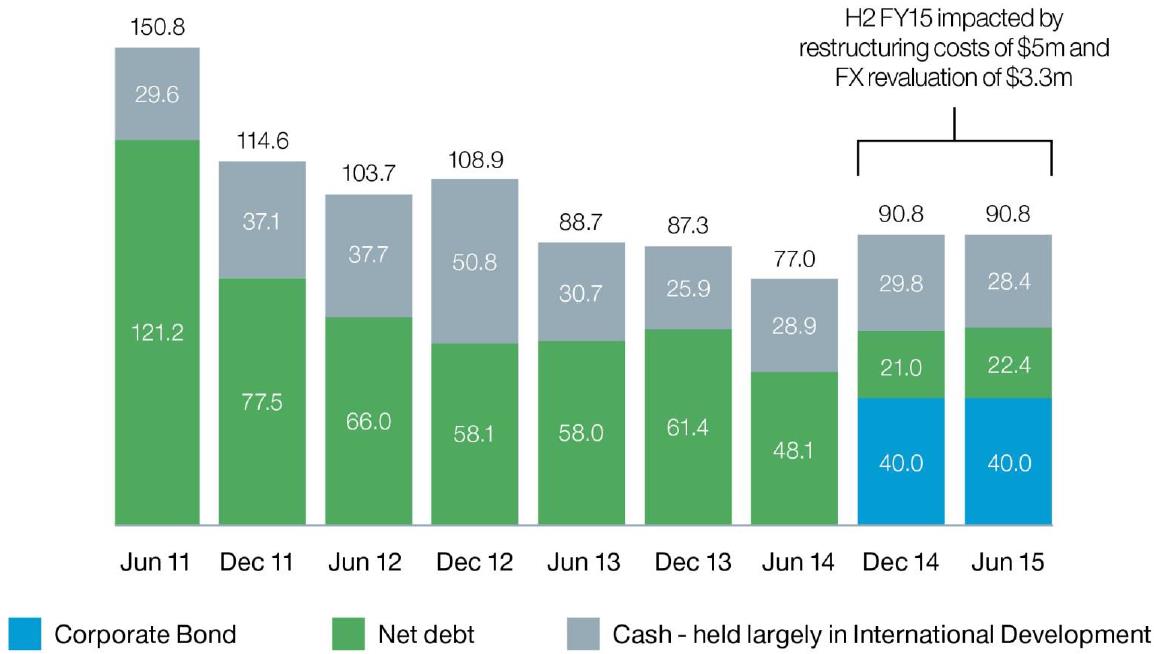

Debt profile

Source: FIIG Securities, Coffey

Net debt increased to $62.4m from $48.1m FY14 and total debt was $90.8m FY15. This was impacted by the restructuring costs as well as the falling AUD. A total of $33m of debt is in USD via its US subsidiary (as income is generated in USD in that part of the business). Therefore when translated into AUD for reporting purposes the FX translation added $8.1m to debt FY15.

In total at YE15 there was $50.8m of secured bank debt in front of bondholders with an expiry of September 2017. We also note ‘off balance sheet’ self-secured operating leases of $19.9m due within one year, $54.9m within one to five and $30.7m in five years plus.

Key credit considerations

- Relative value: With one of the highest AUD trading margins of around 650bps, investors are being paid to take the risk - the bond looks fair value. We do not expect material improvement in the credit profile in the medium term

- Key risk: Debt refinance: There is expected to be less EBITDA than forecast and the level of debt to repay has risen – while the term to maturity shortens. There is also significant secured bank debt in front of bondholders due for renegotiation in September 2017.Currently, gearing is too high for a bank to refinance the bonds so the reduction of debt over the medium term is important

- Outlook: The continued increase in forward contracted fee revenue is positive, albeit in the 12 month plus category. It is also noted the company has exited the volatile mining/oil/gas sector (except for a small amount of later stage and remediation work) which should reduce the possibility of further restructure/write downs

- Relatively small company: with associated limited financial flexibility (market cap ~$35m)

- Equity raising/asset sales: Access to equity markets may be limited as last time Coffey went to the market in 2011, the underwriter was left with ~70% of the $22m retail offer (while the institutional offer was fully raised: $18m). If needed however, Coffey could sell its separate US based international development business MSI (bought in 2008 for around AUD$30m), and potentially other aid businesses which are profitable